Given that the IRS has rigid needs with regards to purity and provenance of coins prior to buy for an IRA account. Normally confirm their IRA metal eligibility initial!

While supplying diversification in just gold investing, they do include management charges which could likely have less immediate correlation to cost actions in contrast with physical gold or ETFs.

An IRA was then designed as an easy, tax-deferred way for Us residents to save for retirement savings accounts.

On obtaining the gold assets, the depository will inform your gold IRA custodian and then he/she will document the purchase of your gold and fork out the seller. And that's the way you grow to be the owner of the gold IRA account.

With the uses of answering this concern, We'll assume that “safe” implies that the investment incorporates a significant chance of constructing a favourable return and that cash is preserved. Using this type of in mind, can buying gold through an IRA be considered a safe investment?

They may also give a representative who will reply all issues You could have right after obtaining reviewed the requested components. When considering a gold IRA enterprise, it really is strongly click here for more info instructed that it:

I’m happy you’ve identified the ideal match for your needs. We do Consider American Hartford is setting new excellent specifications for gold IRA companies.

Remain Educated: As is accurate with any investment, keeping up to date on world financial factors, central lender decisions, geopolitical circumstances and geophysical realities will give traders insight into prospective price tag movements of gold and other precious metals.

Having said that, as a lot more buyers searched for tangible assets like precious metals to diversify their portfolios past stocks, bonds, mutual funds, and CDs – this necessitated the introduction of “Gold IRAs” through the 90s.

A gold IRA custodian refers back to the financial institution chargeable for running your gold IRA account plus the assets held by it. In such cases, the assets include things like gold bullion coins or gold bars.

This feature provides you with supplemental flexibility in choosing a custodian Along with the conditions and costs you like best.

In the event you Totally need to have a gold IRA, we’ve damaged down the best options available to you. But be sure to Keep in mind that even the best of the bunch aren't find more info exceptional Learn More Here investments to your tricky-acquired retirement bucks.

On top of that, precious metals are inclined to provide a long-term boost in benefit regardless, which makes them ideal components for that extensive-expression investment tactic of a retirement portfolio.

Being a retirement investment alternative, a gold IRA rollover is consequently a wonderful decision. While it will likely not always give the very best rate of return, it is without doubt one of the best methods to protect the worth of one's retirement investments.

Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Jaclyn Smith Then & Now!

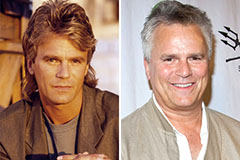

Jaclyn Smith Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!